From 400 to 800 — The Blueprint That Changed Everything.

A visionary coach. A master of consumer law. A proven record of restoring lives, one credit profile at a time.

The Mission

Empowerment. Education. Equality in Finance.

Major Solutions was founded on one powerful belief — that everyone deserves an even playing field.

Credit, funding, and financial literacy shouldn’t be reserved for the privileged few. Maurice and his team work to close the gap, teaching real consumer law and helping clients leverage credit as an asset — not a limitation.

This isn’t just about removing negative marks; it’s about restoring confidence, creating leverage, and building financial independence that lasts a lifetime.

Mentorship & Credit Coaching

Because fixing credit is only step one.

Maurice built Major Solutions to teach clients not just how to repair credit, but how to think like lenders. His mentorship programs provide in-depth training on consumer law, wealth strategy, and the mindset required to sustain long-term success.

Through one-on-one sessions, group workshops, and personalized financial blueprints, clients learn to transform credit from a score into a source of power.

Programs Include:

Credit & Wealth Strategy Coaching

Long-Term Credit Maintenance Plans

Funding Readiness Consultations

Business Credit Education

About Maurice Lewis Jr.

The story of transformation

— from rock bottom

to industry leader.

Maurice Lewis Jr. began his journey in a place few would expect a financial expert to start: a 400 credit score and a burning determination to change his life.

He spent six months completely focused — shaved head, no distractions, just discipline. During that period, he studied the Fair Debt Collection Practices Act (FDCPA), Fair Credit Reporting Act (FCRA), Truth in Lending Act (TILA), and UCC codes, mastering the laws that govern credit and consumer rights.

What started as self-education became a calling. Maurice began helping friends and family win court cases, delete inaccurate debts, and restore their financial standing. Word spread fast.

Now, with over five years in the industry, more than 2,500 clients served, and $80 million in credit debt deleted, Maurice has built a trusted brand that stands for transparency, precision, and results.

His mission is simple — to give real people real power. To make the system make sense. And to prove that knowledge is the ultimate leverage.

Pricing Plans

MENTORSHIP

TRAINING

$3000

✅ WHAT’S INCLUDED

A–Z Business Formation — LLC, EIN, address, phone, email, domain, industry setup

Business Credit Foundation — DUNS, NAV, PAYDEX + real reporting vendors

GoHighLevel CRM Installed — workflows, automations, pipelines, emails/SMS, forms

Done-For-You Website — homepage, services, booking, mobile-optimized, domain connected

Funding-Ready Compliance — banking setup + full fundability checklist

Private Mentorship — 4 sessions (120 minutes total)

Certificate of Completion

All mentorship clients must maintain active business credit monitoring through NAV, Experian, or Equifax Business. This is required for funding qualification and ongoing support tracking.

COUPLES PLAN (2 PEOPLE)

$700 Flat

✅ WHAT’S INCLUDED

Updates are sent every 45 days

10-45 day expedited dispute processing

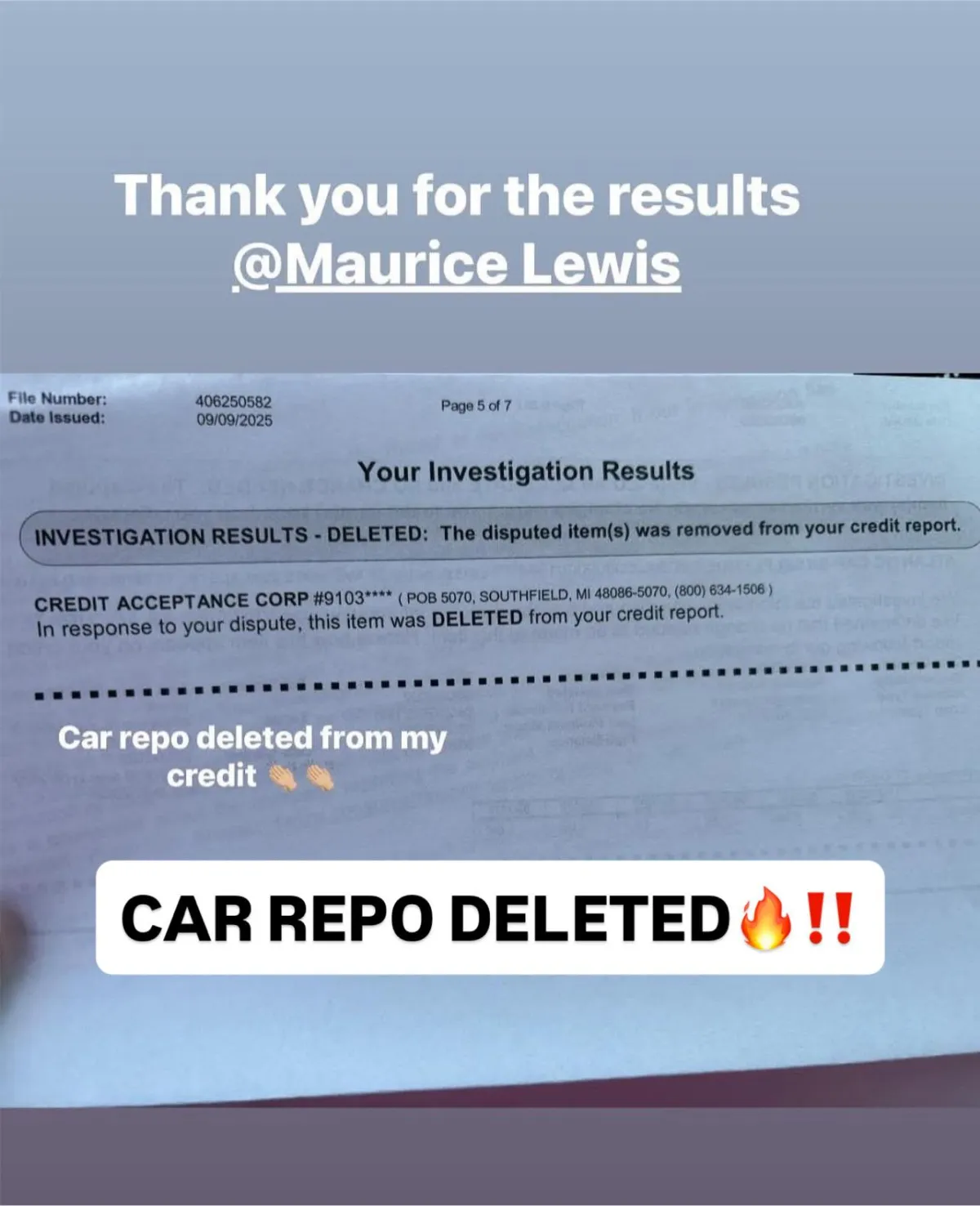

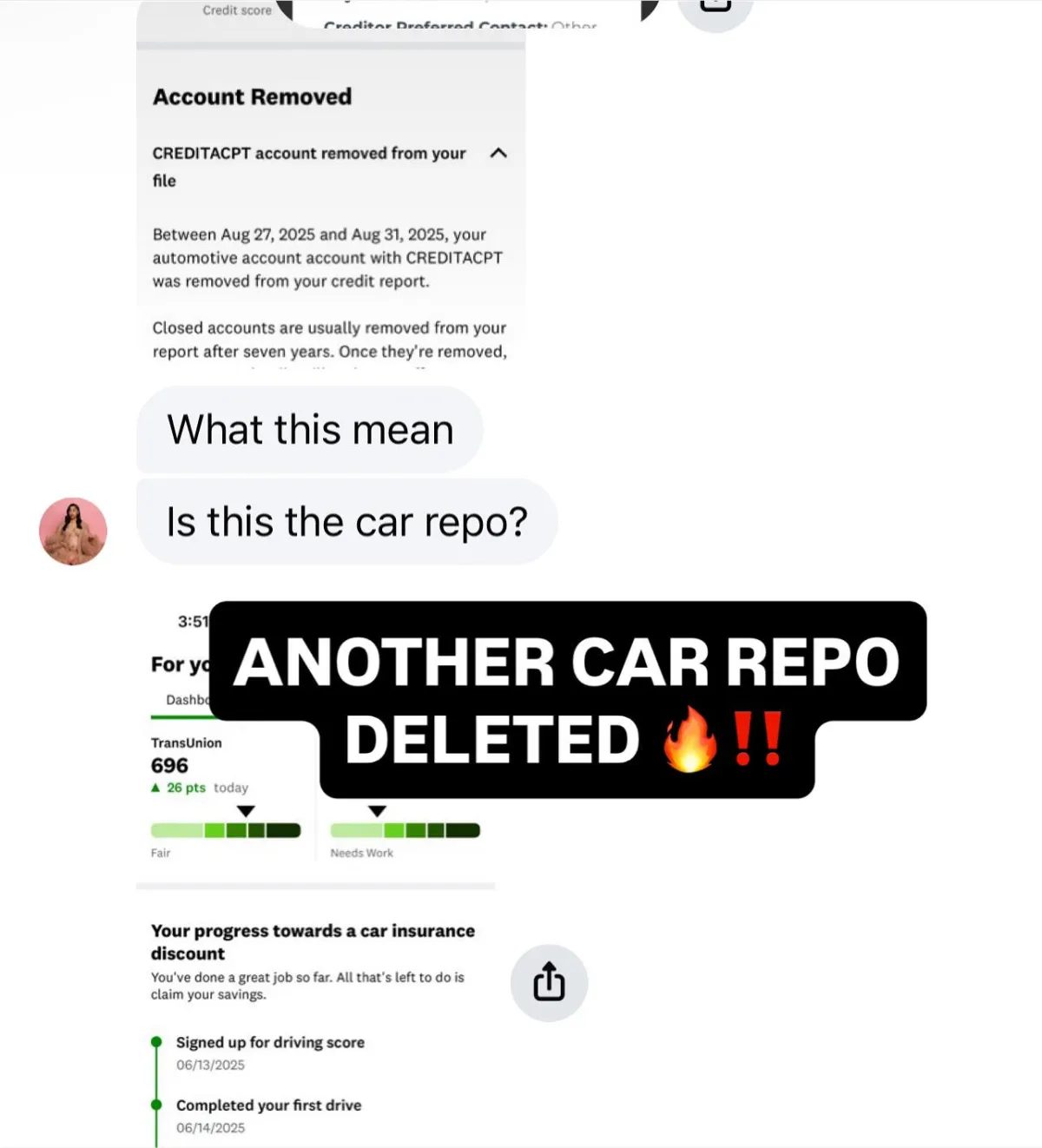

Removal of collections, inquiries, repos, charge-offs, late pays, bankruptcies, medical bills, child support

6 dispute rounds included

Updates every 45 days

24/7 access to Major Solutions Client Portal

Client Support Team

All clients are required to purchase credit monitoring at $22/month through SmartCredit or IdentityIQ so Major Solutions can pull updated credit reports.

FULL CREDIT

SWEEP

$375

✅ WHAT’S INCLUDED

10-45 day expedited results

Removal of collections, inquiries, repos, charge-offs, late pays, bankruptcies, medical bills, child support

6 rounds of disputes included

Updates every 45 days

24/7 access to Major Solutions client portal

Client success support team

Credit monitoring at $22/month is required to pull updates, send disputes, and maintain active service.

\

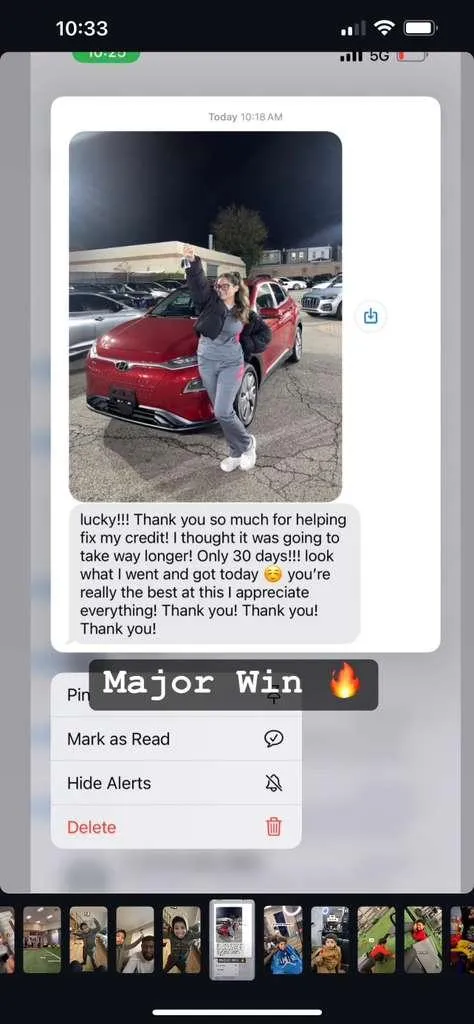

CLIENT SUCCESS STORIES

Why Major Solutions Stands Out

Law meets strategy. Experience meets empathy.

At Major Solutions, success isn’t measured by disputes sent — it’s measured by lives changed.

Every client is treated like a partner in progress. The team applies advanced consumer law principles, data-driven dispute tactics, and hands-on mentorship to ensure long-term financial health.

This is not quick-fix credit repair. This is the art and science of financial restoration — delivered with professionalism, charisma, and genuine care.

Start your comeback story today.

Major Solutions works with clients in all 50 states, offering personalized strategies, transparent communication, and measurable results.

Whether you’re repairing your personal credit, seeking business funding, or simply ready to learn how to play the financial game at a higher level — the team is ready to help.

Other Links

Home

Our Services

Book A Call

© Copyright 2025 Immense Ability - All Rights Reserved.